Stock flow model bitcoin

ETH Price Analysis and Prediction – Ethereum Price Continues to Trade Sideways, Trading Volume Drops

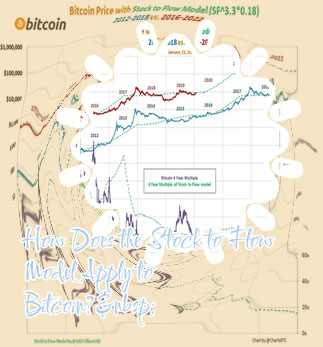

Stock refers to the total amount of an asset, whereas flow refers to the amount produced or mined per year. We can calculate the Stock-to-Flow ratio using these two metric (stock and flow) and dividing the stock by the flow. The higher the stock to flow ratio, the less new supply enters the market relative to the total supply. Assets with higher Stock-to-Flow ratios theoretically retain their value well over time. Bitcoin stock to flow live In some ways, I think we\u2019re already seeing this effect. Right now, Bitcoin\u2019s stock-to-flow ratio is roughly equal to gold\u2019s. However, gold\u2019s total valuation is 20x greater. This gap isn\u2019t because gold is a better store-of-value, but instead because it is a familiar and trusted store-of-value. It would take a generation or even two before Bitcoin\u2019s valuation caught up to gold\u2019s if they continued to have equal stock-to-flow ratios. (But, luckily, that is not the case. Bitcoin\u2019s stock-to-flow ratio will continue to get 2x better every 4 years.)

Stock to flow btc

Cryptocurrency analyst PlanB states in a YouTube video that he believes Bitcoin (BTC) is on the cusp of entering a new bull market phase. How Is Bitcoin S2F Calculated? The crypto strategist popular for applying the stock-to-flow (S2F) ratio to Bitcoin reveals that the model has printed a signal that has not been seen since the crypto bull run in 2017.

Is the Stock-to-Flow Model Accurate

There are still only 21 million Bitcoin, it is still an uncorrelated asset, it is still a censorship-resistant global p2p payment network used by millions, and the tech is still developing at a record pace. How Does the Stock-to-Flow Model Work? The first leg of our stool—the assertion that stock-to-flow and bitcoin’s price are related—is structurally sound. The strongest support for it is empirical: Bitcoin’s stock-to-flow ratio has gone up significantly over the past 15 years, and so too has its price, producing an R-squared of about 0.94. We can see just how strong that relationship is when we overlay the rising stock-to-flow ratio with bitcoin’s price.

Bitcoin stock to flow live

Despite the drawback, Stock-to-flow chart on price value predictions can be added to the list of financial strategies and advice that one would take up before investing in cryptocurrency. Bitcoin ‘stock-to-flow’ model predicts bullish price outcome post halving For people who are new to the bitcoin ecosystem, it will interest you to know that the bitcoin address is pretty much similar to a traditional bank account. Using this address, you can make deposits. The only difference between a bitcoin address and your regular bank account is that with bank accounts, you don’t need private keys before you can spend the money in your bank account. And because bitcoin is designed to be scarce, you can expect the value to continue to increase.

- Crypto coin wallet

- Cryptocurrency to buy

- Btc live price

- Cryptocurrency exchanges

- How does bitcoin make money

- Crypto interest

- How much is pi crypto worth

- Visa crypto

- Etherium vs etherium classic

- Cryptocurrency prices

- Bitcoins lowest price

- Should i buy bitcoin or ethereum

- Cryptocurrency market capitalizations coinmarketcap

- Who own bitcoin

- Buy ethereum with credit card

- Titan token crypto

- Cryptocurrency bitcoin price

- Apps to buy cryptocurrency iphone

- Bitcoin starting price

- Buy bitcoins no verification

- Ether 1 crypto

- Best place to buy bitcoin

- Buy crypto with credit card

- Shiba inu coin cryptocurrency

- Infrastructure crypto

- Crypto debit card

- Buy and sell crypto

- Bitcoin in circulation

- Cryptocom fiat wallet pending

- Cryptocom customer service

- Buy cryptocurrency

- Cryptocoin com coin

- Best crypto exchange for dogecoin

- Should i buy bitcoin before halving

- Cryptocom sell to fiat wallet

- Buy cryptocom coin

- How is crypto taxed

- Brand new crypto

- New crypto coins

- How to buy on cryptocom

- When to sell crypto

- Gala crypto

- Cryptocom login

- Baby bitcoin where to buy

- Will crypto bounce back

- Can you buy dogecoin on cryptocom

- Where to buy shiba inu crypto

- How to sign up for bitcoin

- How to pay with cryptocurrency

- Crypto fees

- Where to buy catgirl crypto

- Bitgert crypto price

- Cryptocom app

- Bitcoin cryptocurrency

- Crypto credit

- Bitcoin trend

- Best crypto to buy

- Google bitcoin

- Cryptocom sign in

- Cryptocom news

- How much is bitcoin

- How to start a crypto exchange

- Crypto com referral